How do structured settlements compare to other investments?

Consider the following three examples.

Structured Attorney Fees vs. Taxable Investment Account

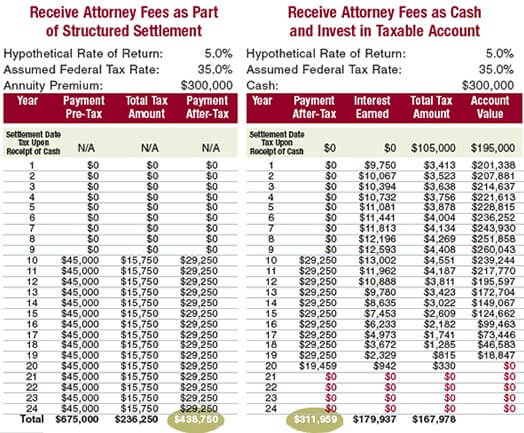

Compare a structured settlement annuity with an alternative taxable investment account. The taxable account would require an additional 2.7% rate of return to match the structured settlement annuity level payout

Same rate of return comparison

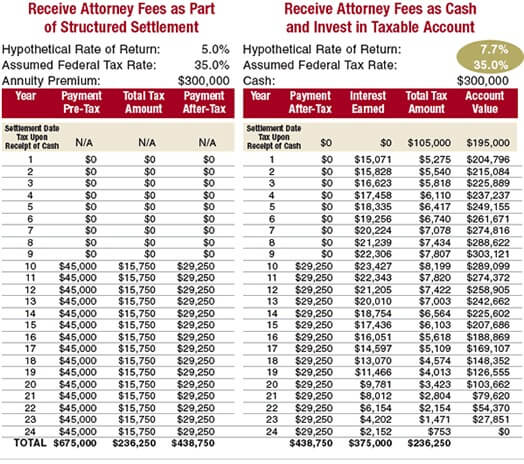

Let’s assume that the structured settlement annuity and the taxable account both offered the same rate of return. Payouts for the taxable account would be $7,071 less than the structured settlement payout each year – that’s a total of $106,065 less!

Same Rate of Return and Equal After-Tax Payments

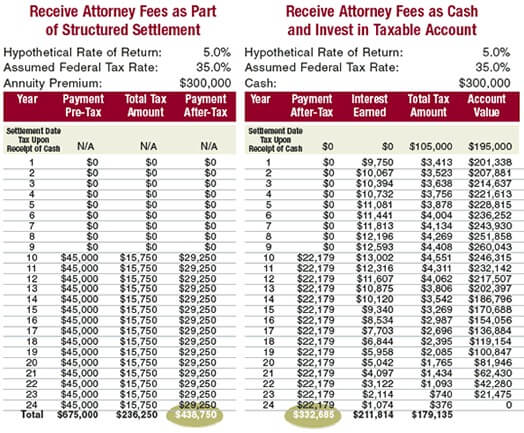

Assuming equal rates of return and after-tax payments, the taxable investment account ultimately runs out of money during the payout period. Bottom line – the taxable account pays $126,791 less in after-tax payments than the structured settlement annuity payout and is depleted sooner.